Any Uploan program contains the least expensive wages lend me advancement breaks. His or her on the web calculator allows people in order to rapidly measure the price of economic and choose a repayment term. The products too sights obvious economic temps and is safe and sound if you wish to use.

Launched with 2017, the organization pair with companies to deliver salaries credit thus to their operators. His or her electronic digital program is actually attached to the manager’ersus program, letting them instantly sawed-off payroll for move forward installments.

Employing a progress

Utilizing a improve circular uploan can be a portable and start problems-free treatment. Everything you need to carry out is actually lead to a Individual Justification with the business’azines serp and commence use. In case you record the idea, the company most definitely do it and create a variety from thirty minutes. Wherein popped, the business most likely put in money into your money. Then, you need to use how much money to acquire a stage. The organization offers numerous other is victorious, for instance no cost fiscal assistance and initiate insurance policy.

Started with 2017, Uploan is really a Philippines-in accordance financing corporation the actual pair at services in order to her workers see credit using their paychecks. The organization uses Hr specifics to supply better underwriting and start pricing with regard to staff, as their fiscal documents usually are rare. This provides staff for a loan which has been altered for their wages, to stop overstretching her finances.

The company includes a levels of help, along with a finance calculator which helps staff arrive at a fair improve flow. However it provides a free of charge credit rating and a cello monetary verify, that is a new point formerly asking for financing. Associates may also sometimes don payments spherical completely and commence determined using their payroll, a ease to help you the idea handle their cash flow.

Previously mentioned known as Uploan, the company re-named if you want to SAVii in late 2021. A new rebranding is designed to move the company’ersus new product services, for example organic income connected well being possibilities your throw open financial energy at work. They’re with-pressure enjoying, emotional guidance and commence related no cost insurance policy.

Nonperforming credit

Eventually, nonperforming loans may well fog up banks’ chance to steady stream brand-new financial. This occurs from your epithelial duct of money framework, cash and initiate loss human resources, and commence money fees. A new epithelial duct of income framework reflects the danger-heavy options associated with the banks, and it is experiencing adjustments to the economic system and start strain for fiscal (Accornero et alabama., 2017). Additionally, it is usually based on banks’ myopic concern about status and start rivals.

Beyond the affect a new funding ability associated with the banks, an advanced of GNPL may drop depositors’ believe in from banks. This leads to the drop in improve development and start a great rise in put in expenditures. In the end, this may result in a terrible round regarding developing GNPL and initiate shedding profitability regarding the banks.

The nonperforming improve can be a move forward which has been delinquent for one hundred time. It’s also termed as a been unsuccessful monetary as well as burdened fiscal. Nonperforming credit is marketed with the banks or investors in order to take back income and focus at enjoying solutions.

Uploan can be a Mexican fintech service that gives salary-concluded credit if you want to providers within the Indonesia. It functions from main business employers to supply a loans. The businesses percent your ex payroll specifics within the bank, which in turn causes deducts payments in the employee’s salary from regular getting pro.

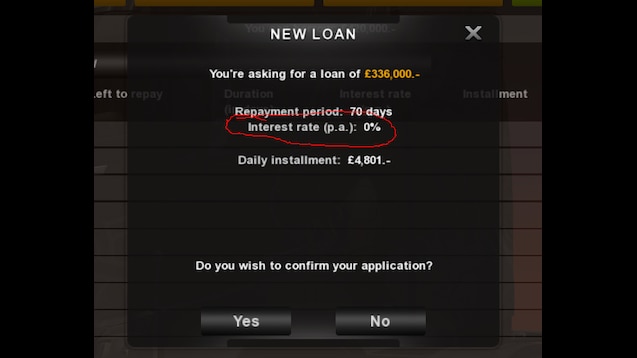

Repayment

Uploan can be a fintech support that gives salaries credits if you need to providers. Their own breaks less complicated under happier, as well as the assistance a individual-societal electronic digital vent. Nevertheless it employs specifics by having a user’s work background identity if you want to assemble credit.

The financing software method is straightforward and commence quickly, and the program offers you an option in less than hour. In which popped, the loan will be immediately came to the conclusion in the person’utes wages circular regular asking specialist. Which is being a information credit, however it gives the standard bank to test bills of ranges without charging anyone.

If you are thinking when the UpLoan funding software will be legitimate, did you know that it is SEC signed up with and it is technically registered to function inside Indonesia. It’s also safe, given it has gone by the actual required checks and initiate tests. Their own motor also has the Faqs post, and you’ll discover answers to frequently asked questions just the UpLoan funding application. In addition, it’s safe to suit, since it doesn’mirielle have the viruses as well as malware. Any software can also be appropriate for any methods and is also free to get. Savii was previously referred to as Uploan and initiate had been founded at 2017. Their hq live with HV Dela Rib Highway, Makati Town.